How startup funding affects equity ownership

Business StrategyEntrepreneurshipFounder ResourceTalent ResourceKey take-aways (read the original full post here) :

- 100% of £15,000 is a lot less than 15% of £2.6b

- You give away a big chunk of equity to co-founder(s) because although you originated the idea, an idea alone is worth nothing – it needs the right team to execute and develop it into a business (in the hypothetical example below, you give away 50%)

- The first sum of investment is likely to be from family & friends, they’ll invest at the lowest price or biggest discount because they’re taking a big risk by being one of the first to invest (in the hypothetical example, you give away 5% and you and your co-founder would dilute down to 47.5%)

- An option pool (where you ring-fence off a proportion of shares to give to future employees) should be created because future investors will want to see you have one (in the hypothetical example, you ring-fenced off 20% at the same time as receiving your first investment, diluting you and your co-founder down to 37.5%)

- You go on to raise seed investment from an angel investor (in the hypothetical example, you agree to give 16.7% of the company, diluting you, your co-founder, the existing investor and option pool)

- In the hypothetical example, you go on to raise investment from a venture capital firm which takes 33.3% share of the company and employee #1 receives 1.8% of the company because they agree to accept a below market rate salary, compensated with shares (as opposed to share options) which further dilutes all existing share holders

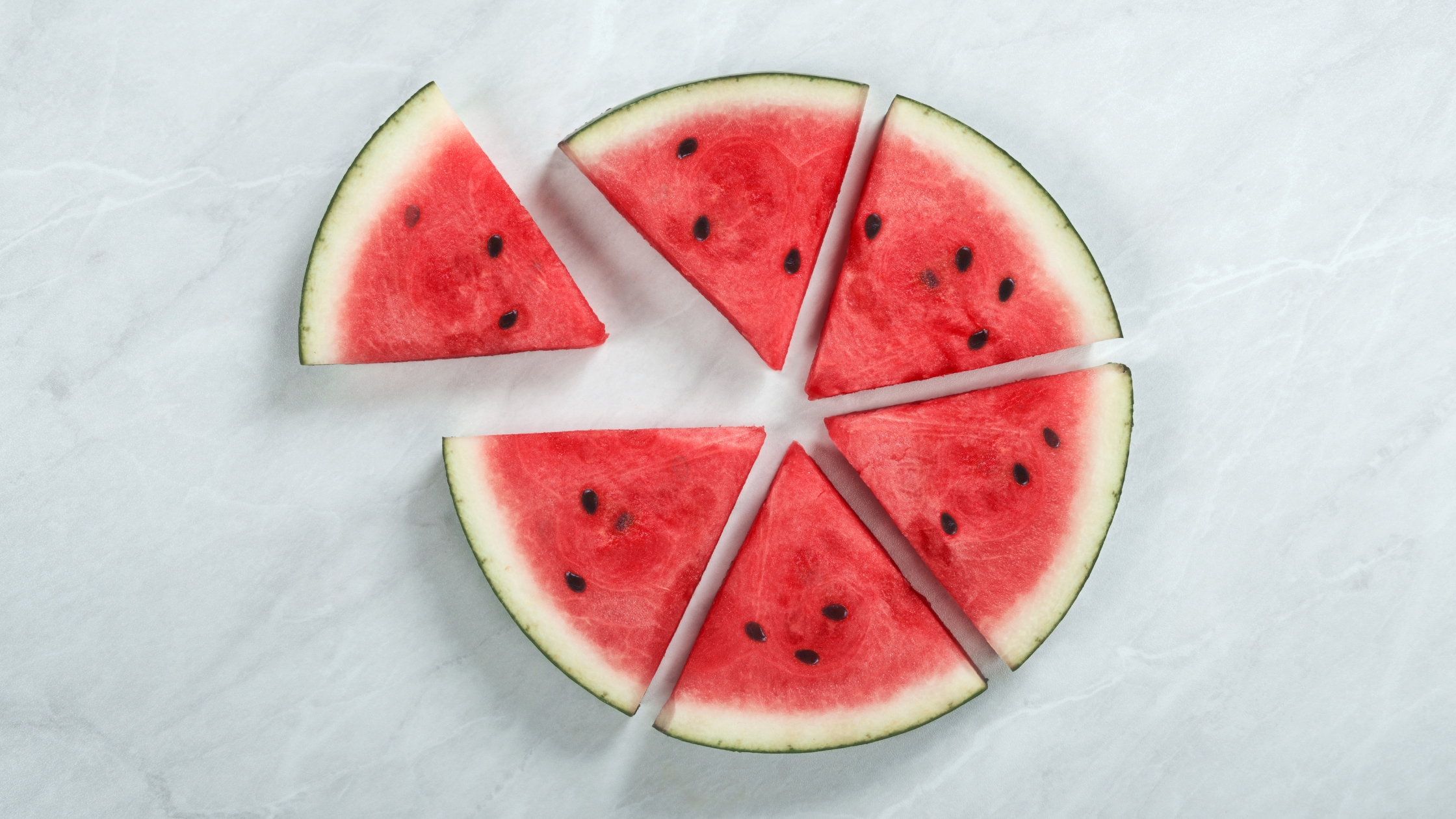

- Dilution is not a bad thing – at each point of dilution, your company is growing in value (the pie gets bigger). The thing to be wary of is losing control of your company – this can happen if you give away too much equity during the early stages without having planned how much sweat equity you may need to award or how many rounds of investment you may need